Financial needs often arise without warning—a marriage, a medical emergency, debt consolidation, or bills piling up. You might ask yourself, “Which is the best option: credit card vs. loan?” The truth is that the answer depends on your goals and repayment habits.

Both credit cards and personal loans are unsecured credit options, meaning they don’t require collateral. Offered by banks and non-banking financial institutions, they differ significantly in terms of structure, cost, and usage. A clear understanding of personal loans vs. credit cards can empower you to make a more informed and cost-effective decision.

Understanding Personal Loans vs. Credit Cards

Personal Loans

Personal loans are fixed-amount borrowing solutions that provide a lump sum upfront. These loans typically come with fixed interest rates and predetermined repayment terms, usually 12 to 60 months. Whether you’re consolidating debt, financing home improvements, or covering unexpected heavy expenses, personal loans offer a structured borrowing approach with predictable monthly payments.

You can calculate personal loan interest rates and EMIs using our Manba Finance EMI calculator.

Credit Cards

Credit cards provide revolving credit lines that allow you to borrow up to a specified limit, repay, and borrow again. They offer unparalleled flexibility in spending and repayment but often come with variable credit card interest rates and high annual percentage interest rates (APRs) that can lead to high costs if not paid off within the grace period.

Key Differences Between Personal Loans vs. Credit Cards

| Aspect | Personal Loans | Credit Cards |

| Repayment Terms | Fixed repayment period, ideally ranging from 1 to 5 years. | Revolving credit with shorter repayment periods, usually set by the creditor. |

| Charges & Interest Rates | Fixed interest rates are based on your credit score. Costs like processing and late fees may be charged based on the loan provider. | Variable with high APRs if re-payment is delayed. Additional fees, like foreign exchange, cash withdrawal, annual fee renewal, etc., may be applied if your card features don’t cover them. |

| Borrowing Limits | A rather large lump sum amount than a credit card. It depends on one’s credit history and income level. | Credit cards can only be used to spend up to their predetermined credit limit. This limit can increase based on your credit report & history. |

| Eligibility Criteria/ Documentation | For personal loan eligibility, individuals must present documents such as income statements, proof of identity, and proof of residence. | Individuals with a good credit history and score can get pre-approved credit cards, requiring no/few documents. Those with no solid credit history may have to provide various documents depending on the lender’s requirements. |

| Usage | Ideal for immediate and heavy expenses | Ideal for purchasing goods/services or to cover short-term expenses. |

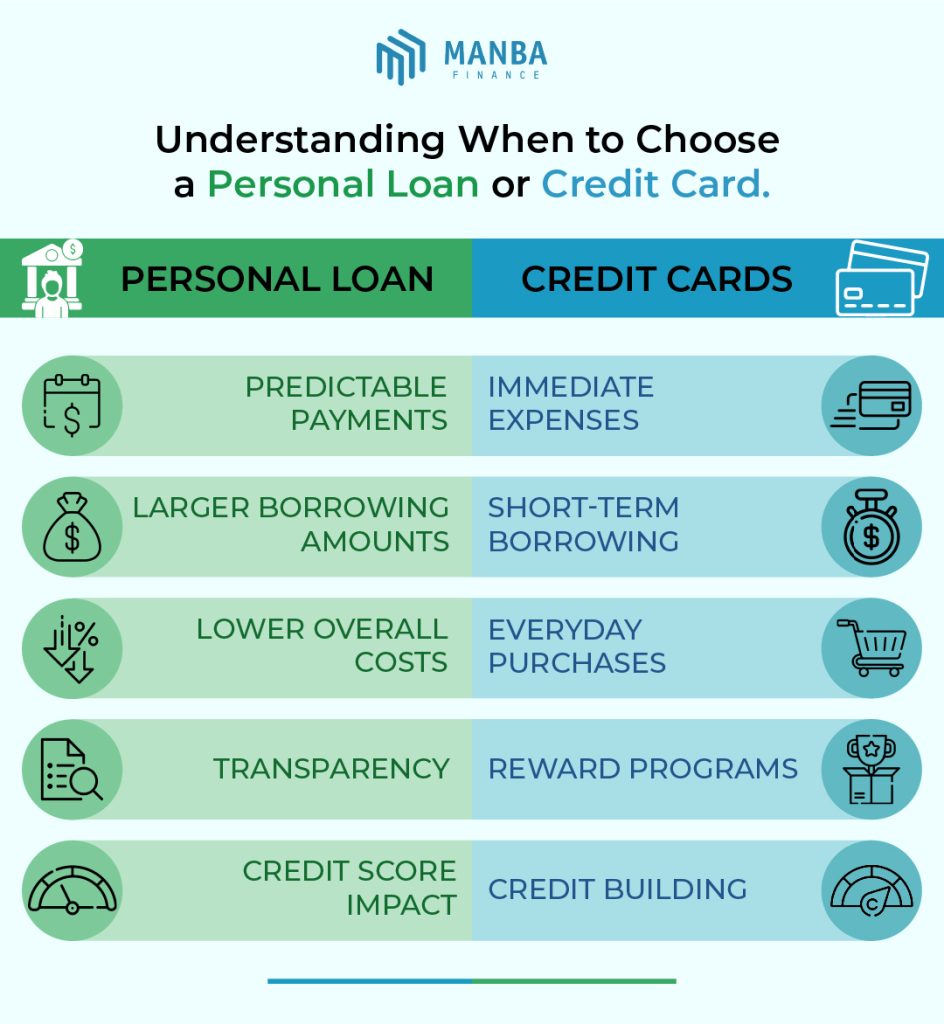

Situations Where Personal Loans May Be a Better Choice

Personal loans are better appropriate for large-ticket purchases. Here are a few situations where a personal loan can be used:

- Debt Consolidation: When juggling multiple credit card interest rates and balances, a personal loan can simplify your finances by combining all debts into a single, lower-interest payment. This consolidation can save you money and help you become debt-free faster.

- Planned Expenses: Big-ticket items like weddings, home renovations, or medical treatments often require substantial funding, which personal loans cater to effectively.

- High-Interest Debt Payoff: Using a personal loan to pay off high-interest debts or loans can significantly reduce your interest expenses.

Credit Card vs. Loan: Factors to Consider When Deciding

Both personal loans and credit cards serve distinct purposes and can be pretty valuable. However, the best option depends on your specific needs. So, before choosing between personal loans vs. credit cards, evaluate:

- Interest rates and fees – Compare the fixed rates of loans to the variable APRs of credit cards.

- Credit Impact – High credit card utilization can lower scores, whereas consistent loan repayment improves them.

- Required borrowing amount – For higher loan amounts, take out personal loans; for daily or smaller expenses, opt for credit cards.

- Preferred repayment structure – Use personal loans for long-term repayment plans and credit cards for short-term re-payments at 0% interest.

- Approval Process: Personal loan eligibility requires more documentation and time than credit card applications.

Personal Loan Made Easy by Manba Finance

The debate on credit cards vs. loans will always be subjective—they serve distinct financial purposes. A personal loan is often wiser for significant, planned expenses or consolidating debt. Its cost efficiency, structured repayment, and transparency usually outweigh the flexibility of credit cards.

Ready to take control of your finances? Explore personal loan options today and secure your financial future