Your two-wheeler loan eligibility starts with a few key checks. Before lending you money, lenders look at your income, credit score, repayment habits, and job stability to understand how well you can handle the loan.

It’s crucial to understand these points before you apply to an NBFC for a two-wheeler loan. You can avoid unnecessary delays and keep your application clear and reliable. We see many buyers lose opportunities because they rely on assumptions rather than checking their financial standing beforehand.

When you check two-wheeler loan eligibility in advance, you save time and get faster loan approval. You also understand what needs improvement, such as if any part of your profile appears weak, and similar areas. This small step can make your buying journey smoother and more confident.

What Is Two-Wheeler Loan Eligibility and Why Does It Matter?

Your two-wheeler loan eligibility indicates to the lender how comfortably you can repay the loan. It focuses on your income, credit score, repayment record, and daily financial behavior. These details help lenders estimate if offering you credit is safe for them.

When you know your eligibility, you make better choices while planning your purchase. You avoid guesswork, choose the right loan amount, and understand what the lender expects from you. This clarity saves time and keeps your application steady from the start.

NBFCs follow the same core checks as banks, but they use a more flexible approach. They look at your two-wheeler loan eligibility criteria with a practical mindset. Instead of imposing strict rules, they consider your earning pattern, work background, and current needs.

This view is beneficial to first-time buyers or modern-age riders who may not want to adhere to traditional banking norms. We often see applicants with limited credit history qualify easily through an NBFC because its qualifications are more practical and less restrictive.

NBFCs also process applications faster. Their documentation process is straightforward, and their teams prioritize quick verification. This results in faster approvals and quicker disbursals, which means you can get on the road quickly.

Many buyers prefer NBFCs because the two-wheeler loan eligibility check feels simple, friendly, and easy to complete online. It gives you a clear picture of your chances before you even apply, which helps you plan your purchase with confidence.

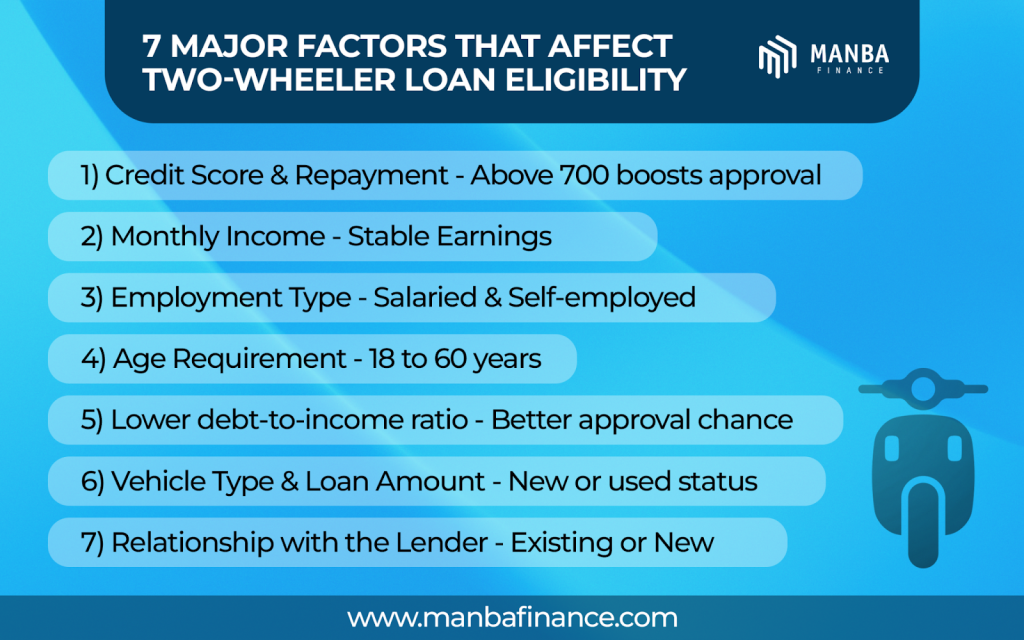

7 Major Factors That Affect Your Two-Wheeler Loan Eligibility

These factors play a central role in shaping your two-wheeler loan eligibility and help lenders measure your repayment capacity with greater accuracy. When you understand them well, you prepare smarter and avoid setbacks during the application process.

- Credit Score and Repayment Track Record

A credit score above 700 signifies a reliable credit behaviour and gives lenders confidence that you can manage repayments on time.

NBFCs may still consider applicants with lower scores, but they will adjust the loan amount, interest rate, or tenure to match the risk. A steady repayment record across past loans and credit cards strengthens your financial profile and can expedite the approval process. You can read more here.

- Monthly Income and Financial Stability

Your monthly income forms a core part of the two-wheeler loan eligibility criteria because it directly influences how comfortably you can handle EMIs. Lenders verify whether your income is sufficient to support the repayment schedule. A stable cash flow provides lenders with clarity and improves your chances of approval.

- Employment Type: Salaried vs Self-Employed

NBFCs evaluate both salaried and self-employed buyers, but they review their financial documents differently. Salaried applicants typically need payslips and bank statements, while self-employed individuals must show income proofs like ITRs or business statements. When these documents are accurate and ready, the assessment becomes quicker and more transparent.

- Age and Work Experience

Lenders assess whether your age and career background indicate steady financial behavior. Applicants within a stable working age and with long-term job experience are viewed as lower risk. This consistency helps lenders estimate whether you can maintain the loan throughout the tenure.

- Existing Loans or EMIs

Your current debts determine your debt-to-income ratio, a key indicator of your ability to afford another loan. If a large portion of your income is allocated to paying off EMIs, lenders may perceive your repayment capacity as limited. Lowering your debt burden or closing smaller loans can improve eligibility and create more room for a new EMI

- Vehicle Type and Loan Amount

Lenders consider the bike’s price, model, and whether it is new or used, as each presents a different financial risk. New bikes often qualify for higher loan amounts due to better resale value and lower risk. Used bikes may receive approval under other terms, which can directly impact your overall eligibility.

- Relationship with the Lender

A positive banking history with the NBFC can work in your favor because they already understand your financial habits. This familiarity can result in quicker verification, smoother communication, and more flexible checks. Existing customers often receive tailored offers or easier document requirements.

How to Check Your Two-Wheeler Loan Eligibility Online Instantly?

You can check your two-wheeler loan eligibility in minutes through an NBFC’s website or mobile app. The process remains straightforward, and you gain a clear understanding of your standing before submitting your application.

- Start by visiting the NBFC’s official site or opening their app. Look for the loan section and select the option to check eligibility. Many platforms place this feature right on the home screen for quick access.

- Enter basic details like age, income, employment type, and city. These inputs help the tool match your profile with the two-wheeler loan eligibility criteria. Keep the information accurate so the estimate stays reliable.

- Use tools such as a loan eligibility calculator or any pre-approved offer checker if available. These tools show the loan amount you may qualify for and the possible EMI range.

- Submit the form to see your instant eligibility result. This action does not affect your credit score, so that you can check it freely. We recommend taking this step before applying, as it prepares you for a smoother approval process.

Tips to Improve Your Two-Wheeler Loan Eligibility Before Applying

Below are a few simple steps to improve your two-wheeler loan eligibility and help you qualify for favourable terms. These actions demonstrate to lenders that you manage credit responsibly.

- Maintain a strong credit score: Keep your credit score healthy by paying EMIs and card bills on time. Late payments can lower your credit score and reduce your chances of approval.

- Clear pending EMIs or credit card dues: Settle any outstanding debts before applying for a loan. A lighter debt load improves your debt-to-income ratio and strengthens your financial profile.

- Choose a realistic loan amount: Request a loan that matches your income level. A practical loan amount helps you meet the two-wheeler loan eligibility criteria without stretching your budget.

- Provide accurate documentation: Submit correct proof of income, identity, and address. Clear documents help lenders verify your details quickly and reduce follow-up queries.

Bonus Tip – Maintain stable employment: A steady job or consistent income source reassures lenders about repayment capability. It can improve your chances of faster approval.

Why Choose an NBFC for Your Two-Wheeler Loan?

NBFCs have become a trusted choice for buyers because they keep the process quick and straightforward. Their approach is flexible, which helps many first-time applicants meet the two-wheeler loan eligibility criteria without stress.

- You get faster processing with NBFCs. Their teams focus on quick checks, lighter documentation, and smooth approvals. It helps you move from application to delivery with very little waiting.

- NBFCs also cater to different income groups with a practical approach. They understand the earning patterns of salaried and self-employed buyers, so the two-wheeler loan eligibility assessment feels more balanced. It can make it easier to qualify, even when your profile is still growing.

- Their paperwork demands stay minimal. You can complete most steps online, easily upload documents, and track the status without confusion. It saves time and reduces the need for back-and-forth communication.

- Another strong point is the personal support you receive. NBFCs guide you through repayment plans, loan amount selection, and eligibility checks. It helps you pick a loan that fits your budget and meets the two-wheeler loan eligibility criteria.

For a seamless buying journey, apply with Manba Finance today and check your two-wheeler loan eligibility in minutes.

Conclusion: Plan Smart, Ride Smart

Understanding your two-wheeler loan eligibility makes buying easier and more predictable. It helps you align your income, credit score, and repayment habits with lender expectations. Checking eligibility beforehand gives you confidence, highlights areas to improve, and can lead to better interest rates.

Using an NBFC’s online eligibility checker takes just a few minutes and does not affect your credit score. A well-prepared application reduces delays and surprises. Take a moment to check two-wheeler loan eligibility and start your ride with a smart, stress-free plan.